What is a 457(b) Plan?

A 457(b) plan, also known as a deferred compensation plan, is a tax-advantaged retirement savings plan for employees of certain state and local governments, as well as tax-exempt organizations.

It is a valuable retirement savings tool for eligible employees, offering unique tax advantages and flexibility. Understanding the benefits, disadvantages, and contribution limits can help maximize retirement savings and achieve financial goals.

History

Created to offer public employees a way to save for retirement, these plans have been around since the 1970s.

Function

Allows employees to defer a portion of their salary into a retirement account on a pre-tax or Roth after-tax basis, up to annual limits.

Tax Benefits

Contributions and earnings are tax-deferred until withdrawal, usually at retirement. Roth contributions are taxed upfront, but earnings grow tax-free.

Benefits of a 457(b) Plan

Tax Deferral

Contributions reduce taxable income and grow tax-deferred.

Employer Contributions

Employers may match contributions, boosting savings.

Flexible Withdrawals

No early withdrawal penalty before age 59½ for governmental plans.

Catch-Up Contributions

Unique three-year Pre-Retirement Catch-Up option for those nearing retirement age.

Disadvantages of a 457(b) Plan

Limited Investment Options

Often fewer choices compared to 401(k) plans.

Eligibility

Only available to certain employees in state/local governments or qualifying nonprofits..

Employer Control

In non-governmental plans, employers own the account, which can pose risks if the employer faces financial issues.

Contribution Limits

Employer contributions count towards the annual limit.

Importance of a 457(b) Plan

Retirement Savings

Provides a critical savings tool for public sector and nonprofit employees.

Tax Efficiency

Offers tax advantages that can significantly enhance retirement savings.

Flexibility

Withdrawal rules are more lenient compared to other plans, making it a valuable option for retirement planning.

Types of 457(b) Plans

Governmental 457(b)

Contributions are held in a trust, protected from employer’s creditors, and can be rolled over into other retirement accounts.

Non-Governmental 457(b)

Employer owns the account, which cannot be rolled over into other retirement accounts and may be at risk if the employer faces financial difficulties.

Impact on Social Security

Contributions to a 457(b) plan do not affect Social Security benefits, which are calculated based on total pay including deferred compensation.

What is a 403(b) Plan?

A 403(b) plan, also known as a tax-sheltered annuity plan (TSA), is a retirement plan that allows employees to save and invest for retirement while receiving tax advantages.

History

Created under the IRS code section 403(b) to help employees of public schools, non-profits, and certain charities save for retirement.

Eligibility

Offered to employees of public schools, non-profits, and other tax-exempt organizations, including teachers, nurses, doctors, and clergy.

How a 403(b) Plan Works

Contributions

Employees can contribute pre-tax dollars through payroll deductions, reducing taxable income. Some plans also offer Roth accounts for after-tax contributions.

Investment Options

Funds can typically be invested in mutual funds or annuities, growing tax-deferred until withdrawal.

Investment Options

Funds can typically be invested in mutual funds or annuities, growing tax-deferred until withdrawal.

Benefits of a 403(b) Plan

Tax Advantages

Contributions reduce taxable income and grow tax-deferred. Roth options allow for tax- free growth and withdrawals.

Employer Contributions

Employers can match contributions, enhancing savings.

Higher Contribution Limits

Allows for higher contributions compared to IRAs.

Flexibility

May offer more flexible withdrawal options compared to 401(k) plans.

Faster Vesting

Employer contributions may vest faster than in 401(k) plans.

Disadvantages of a 403(b) Plan

Limited Investment Options

Often fewer choices, with some plans including high-fee annuities and insurance products with low returns.

Lack of ERISA Protections

Plans without employer matching do not include Employee Retirement Income Security Act protections.

Contribution Limits

Subject to annual contribution limits, which can change annually.

Importance of a 403(b) Plan

Retirement Savings

Essential for employees of nonprofits and public schools to build retirement savings.

Tax Efficiency

Offers significant tax advantages that can help grow retirement funds.

Employer Match

Potential for employer matching contributions provides additional savings.

Types of 403(b) Plans

Traditional 403(b)

Contributions are pre-tax, and withdrawals are taxed as ordinary income.

Roth 403(b)

Contributions are after-tax, and withdrawals are tax-free.

What is a 401(k) Plan?

A 401(k) is a company-sponsored retirement account where employees can contribute a percentage of their income, often with employer matching.

History of 401(k) Plan

Pre-1978: Cash or Deferred Arrangements (CODAs) allowed employees to defer income taxes on certain retirement savings.

1974: Employee Retirement Income Security Act (ERISA) created to regulate company-sponsored retirement plans.

1978: Revenue Act of 1978 included Section 401, which permitted deferred compensation.

1980: Ted Benna implemented the first 401(k) plan by interpreting the Revenue Act's provisions to allow deferred compensation into retirement accounts.

1981: IRS regulations clarified legality, prompting major companies to adopt 401(k) plans.

1984-1986: Tax Reform Acts tightened rules around 401(k) plans to benefit all employees.

1996: Small Business Job Protection Act simplified retirement plans for small businesses.

2001: Economic Growth and Tax Relief Reconciliation Act introduced Roth 401(k) and allowed catch-up contributions for those aged 50+.

Types of 401(k) Plans

Traditional 401(k)

Contributions are pre-tax, lowering taxable income immediately. Withdrawals in retirement are taxed as ordinary income.

Roth 401(k)

Contributions are made after-tax, and qualified withdrawals are tax-free.

Benefits of a 401(k) Plan

Tax Advantages

Contributions to traditional 401(k)s are tax-deferred, and Roth 401(k) withdrawals are tax- free.

Employer Match

Many employers match contributions, providing an immediate return on investment.

Automatic Savings

Contributions are automatically deducted from paychecks, making saving easy and consistent.

Investment Growth

Funds grow tax-deferred, which can lead to significant growth over time.

Disadvantages of a 401(k) Plan

Market Risk

Investment returns are subject to market conditions.

Fees

Some 401(k) plans have high management fees, which can erode savings.

Withdrawal Penalties

Early withdrawals (before age 59½) are subject to penalties and taxes.

Importance of a 401(k) Plan

Retirement Security

Provides a structured way to save for retirement, ensuring financial security in later years.

Employer Contributions

Matching contributions can significantly boost retirement savings.

Tax Benefits

Offers immediate tax relief (traditional 401(k)) or tax-free income in retirement (Roth 401(k)).

Long-Term Growth

Investments have the potential to grow significantly over time, especially with compound interest.

Why 401(k) Plans Were Created

Legislative Background

Created as part of the Revenue Act of 1978 to provide tax-advantaged retirement savings options.

Unintentional Creation

Originally intended to limit tax-advantaged profit-sharing plans for executives, but interpreted to benefit all employees.

Ted Benna's Role

Advocated for and implemented the first 401(k) plan, leading to widespread adoption.

Key Points to Consider

Start Early

The sooner you start contributing, the more time your investments have to grow.

Employer Match

Always contribute enough to receive the full employer match.

Diversify Investments

Choose a mix of investments to balance risk and growth potential.

Consult Professionals

Seek advice from financial advisors to make informed decisions about contributions and investment choices.

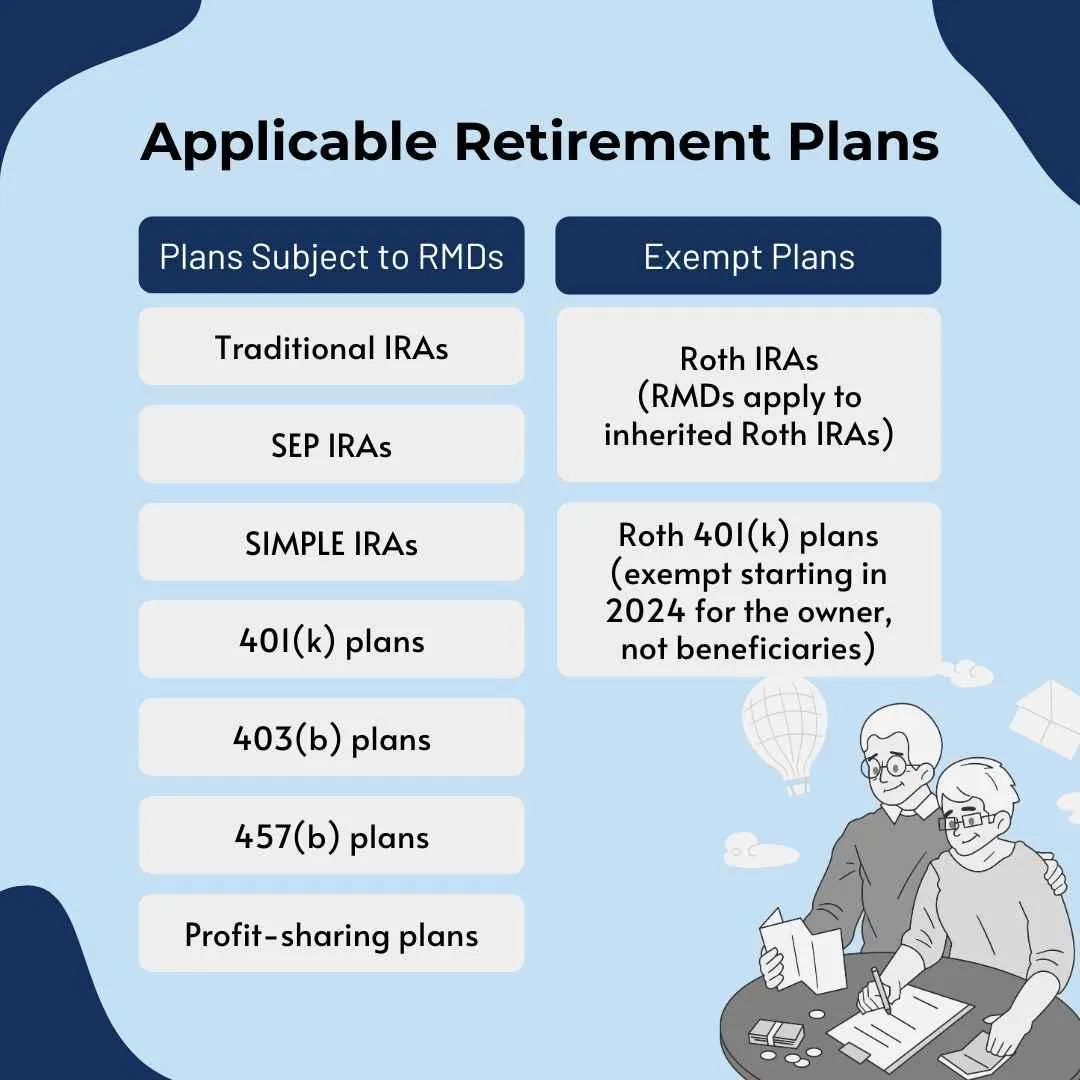

What are Required Minimum Distributions (RMDs)?

RMDs are the minimum amounts that must be withdrawn annually from certain retirement accounts to comply with federal tax rules.

Why RMD Rules Exist

Purpose

To ensure that retirement funds are eventually taxed, preventing indefinite tax deferral.

Creation

Established by tax laws under the Internal Revenue Code to mandate withdrawals.

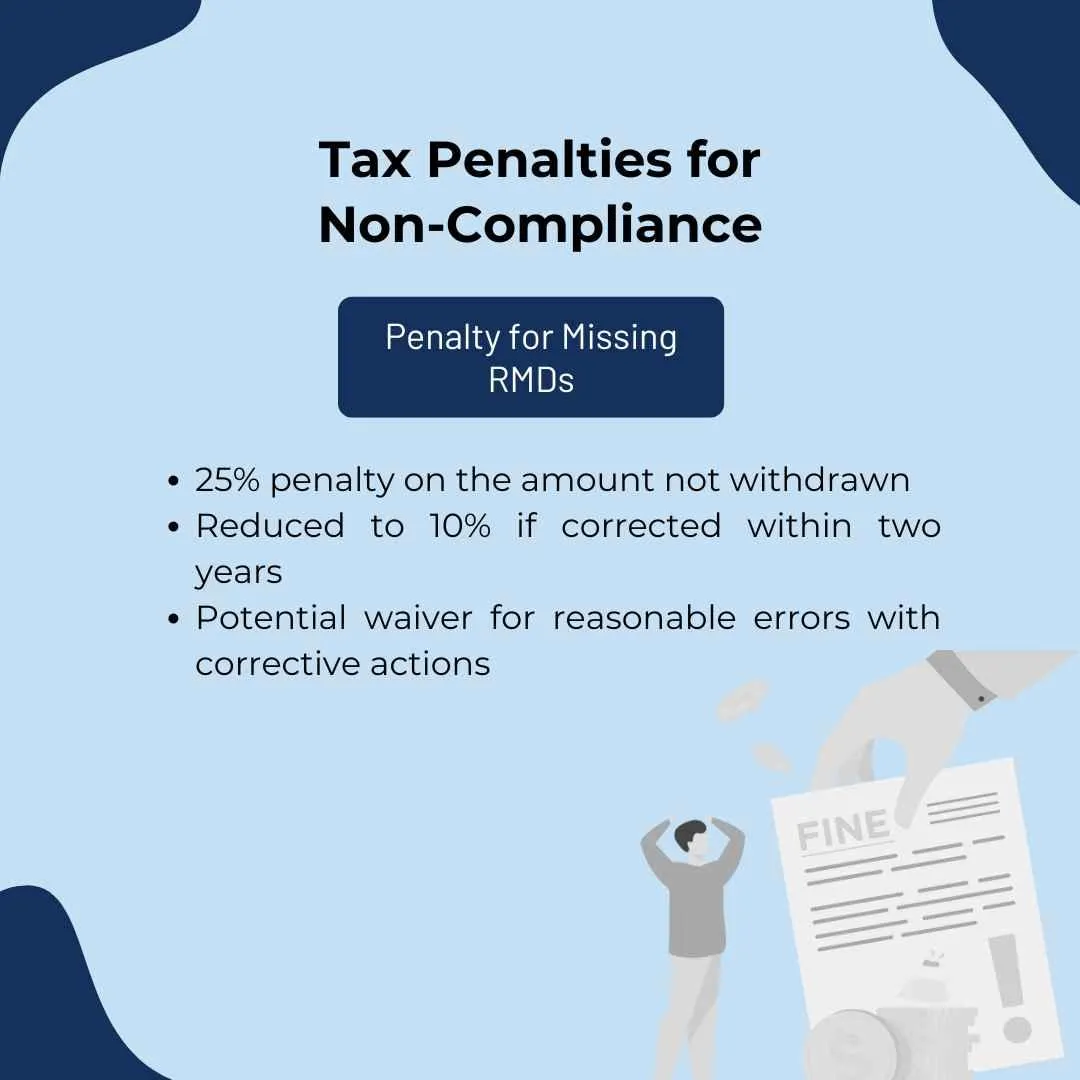

Importance of Planning for RMDs

Tax Implications

RMDs are considered taxable income, which could increase your tax bill.

Avoiding Withdrawals in Down Markets

Proper planning can help avoid having to withdraw funds during market downturns.

Strategies to Manage RMDs

Early Withdrawals

Begin taking distributions at age 59½ to reduce future RMD amounts.

Roth IRA Conversions

Convert traditional retirement funds to Roth IRAs to avoid future RMDs.

Work Longer

Delay RMDs from current employer’s 401(k) by continuing to work.

Qualified Charitable Distributions (QCDs)

Donate up to $100,000 from your IRA to a qualified charity to count toward your RMD and avoid income tax.

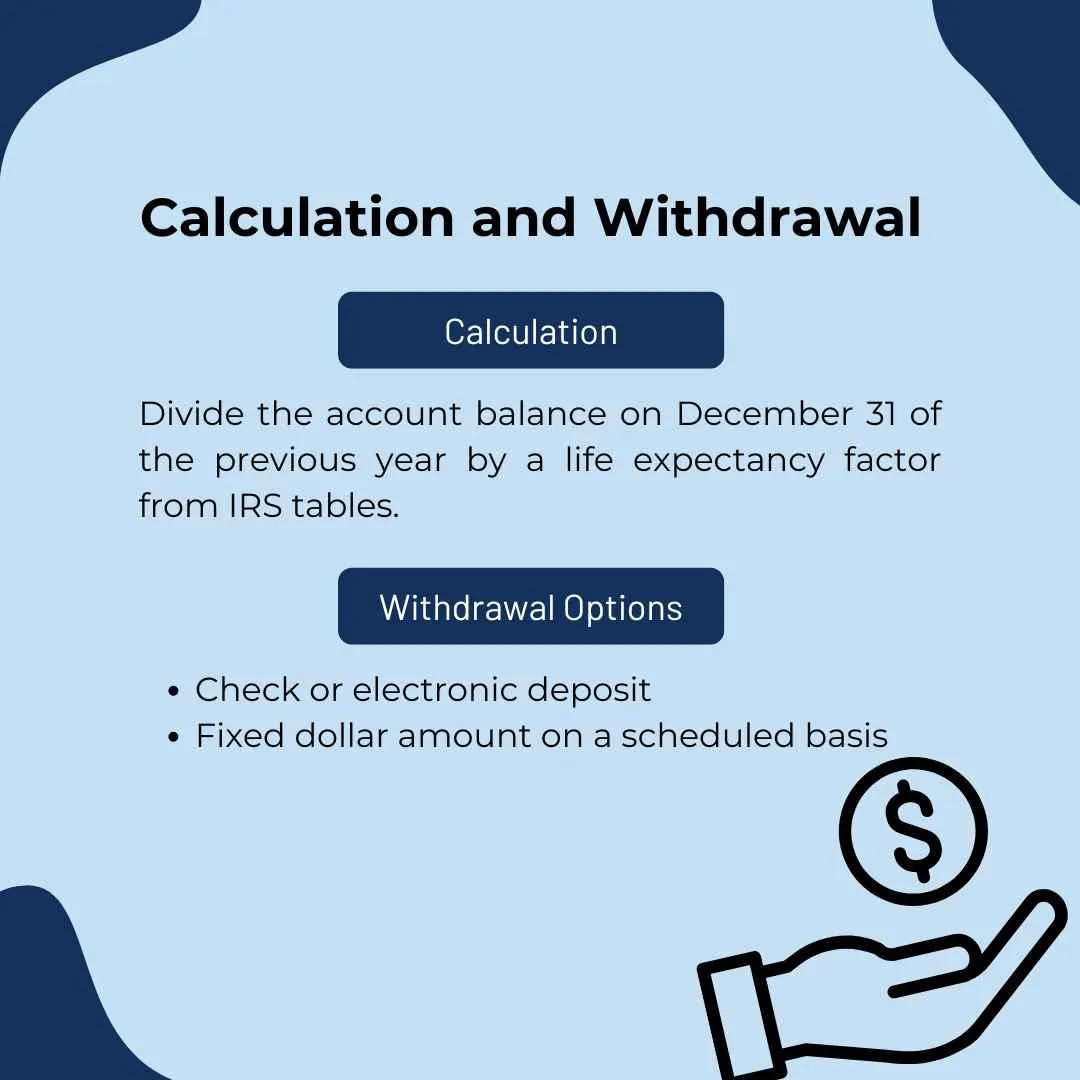

Review Beneficiaries

Use IRS Joint Life and Last Survivor Expectancy Table for RMD calculation if your spouse is at least 10 years younger.